If you pick a good insurer, you could experience a smooth, stress-free claim.

For all of these reasons and more, it’s worth spending time researching a good home insurance provider.

Here are some of the strategies for picking a good home insurance provider, including our tips and best practices.

Check J.D. Power Home Insurance Company Ratings

You can read plenty of guides online about the “Top 10 Best Home Insurance Companies” in the United States. Some lists are unbiased, while others have obvious favorites.

Fortunately, you don’t need to trust random articles online; instead, you can use J.D. Power to assess the quality of home insurance companies across the country.

Each year, J.D. Power polls homeowners across the United States who have recently made a claim. Homeowners describe their experience and overall satisfaction. Then, J.D. Power uses thousands of survey responses to rank today’s best insurers.

J.D. Power recently published the results of its 2023 home insurance study:

J.D. Power Overall Customer Satisfaction Index Ranking for Homeowners Insurance

- USAA (881)

- Erie (856)

- Amica (844)

- Auto-Owners Insurance (834)

- AIG (831)

- State Farm (829)

- COUNTRY Financial (819)

- Segment Average (819)

- American Family (813)

- Nationwide (812)

- Allstate (809)

- The Hartford (807)

- Travelers (790)

- Liberty Mutual (789)

Because USAA restricts membership to military personnel and their families, they weren’t technically eligible for the top spot – despite scoring significantly higher than competitors. According to J.D. Power, Erie Insurance is the best homeowners insurance company in the United States for 2023 based on the overall satisfaction of customers.

Before buying a home insurance policy, check the insurer’s J.D. Power rankings. Many insurers claim to emphasize customer service – only to disappoint customers during a claim. With J.D. Power’s rankings, you get genuine thoughts from customers who have recently made a claim.

You can view J.D. Power’s full 2023 home insurance company rankings here.

Check the NAIC’s Complaint Index

Some insurance companies have a higher-than-average number of complaints compared to competitors.

All insurance companies – even the best-rated ones – get complaints. A homeowner may be dissatisfied with a hidden term in their policy, for example, or have a bad experience with a specific adjuster.

When a company frequently has a higher-than-average number of complaints, however, it suggests there’s something amiss.

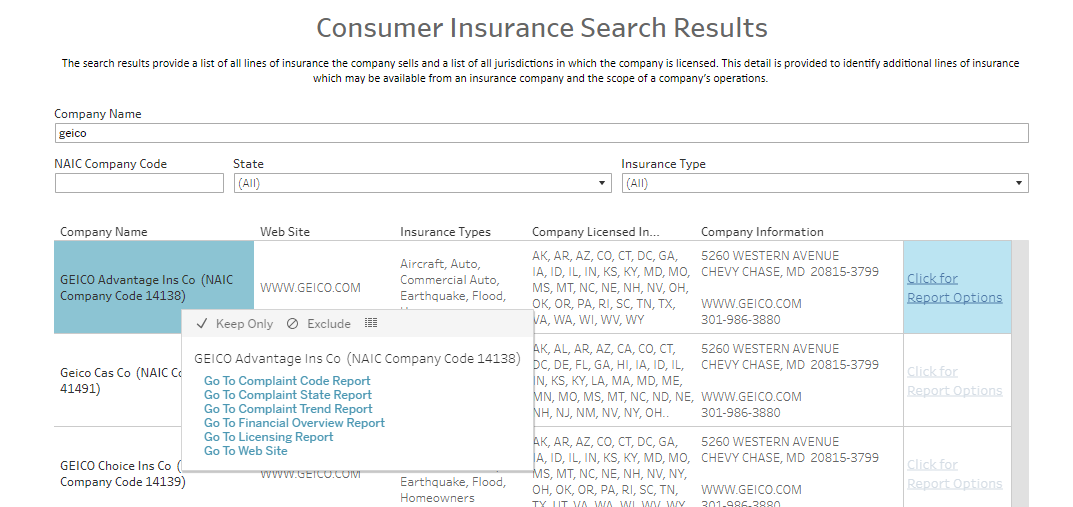

Fortunately, you can check how many complaints each insurer gets using the National Association of Insurance Commissioner’s Consumer Insurance Search feature. The NAIC collects information on each insurer, then tracks the number of complaints about insurers over time.

Here’s how to use the NAIC’s complaint index feature:

- Visit the NAIC’s Consumer Insurance Search form here: https://content.naic.org/cis_consumer_information.htm

- Enter the name of the insurance company you wish to learn more about.

- Click on the company, then click “Go to Complaint Trend Report”

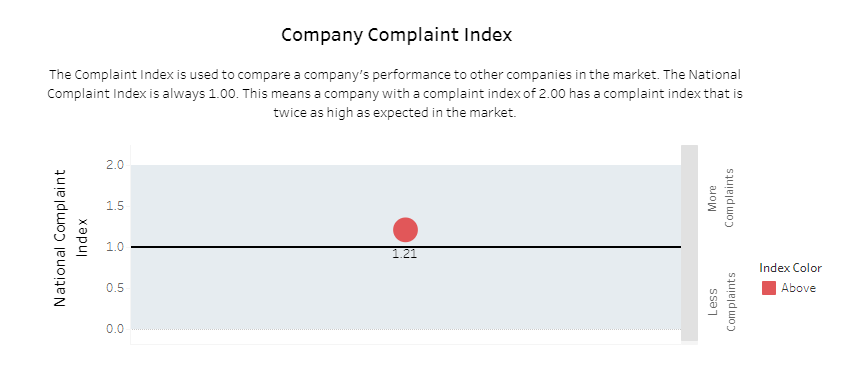

- Look for the company’s Complaint Index. The national average is 1.0. If the company has a number higher than 1.0, then they have more complaints than expected for a company of its size.

In the example below, you can see GEICO has a complaint index of 1.21, for example, which means GEICO receives more complaints than average for a company of its size.

If a company has a Complaint Index of 2.0, it means they have twice as many complaints as the nationwide average.

The NAIC calculates the Company Complaint Index by dividing the company’s share of complaints in the United States market by the company’s share of premiums in the market.

Check your insurer’s NAIC Complaint Index before signing up for a policy. Few insurers publish this information upfront, which is why it’s important to check.

Check a Company’s Financial Strength Rating (FSR)

If an insurance company files for bankruptcy, it is much harder to have your claim paid. Some claims are not paid at all, depending upon how the bankruptcy is structured.

It may sound unlikely, but many insurers are one regional disaster away from declaring bankruptcy. Many filed for bankruptcy in 2023 after Hurricane Ian in Florida.

Fortunately, the best insurers have strong financial strength ratings and a diversified policyholder base. These companies are unlikely to face issues paying your claims for the foreseeable future.

There are multiple ways to check a company’s financial strength rating, including:

- Use A.M. Best’s online form to search for your home insurance company. A.M. Best analyzes assets and liabilities of an insurance company, then assigns a financial strength rating to each one. Financial strength ratings range from D to A++, with A++ being the highest. The stronger your insurance company’s position, the better your financial strength rating will be.

- Use Standard & Poor’s Corporation rates to assess the financial strength of your insurance company. Like A.M. Best, S&P assesses corporations based on their assets and liabilities. However, S&P does not perform an audit in connection with its ratings. You can view S&P’s list of corporations and financial strength ratings here.

- Use other ratings organizations with similar databases, including Fitch Ratings, Kroll Bond Rating Agency (KBRA), or Moody’s Investor Services.

Be Wary of Online Insurance Company Reviews

We haven’t recommended a specific home insurance company on our list, nor have we ranked the top 10 best home insurance companies in the United States. Why? Because many of these lists are biased.

A quick Google search for “insurance company reviews” or “best insurance companies” reveals many websites recommending poorly-rated insurers simply because they get paid for each referral.

Online reviews can also be overly negative – even for good insurers. Most people don’t bother reviewing their home insurance company unless they’ve had a bad claim, for example.

Check insurance company reviews before you sign up. But be wary of misinformation and biased information online – especially if a website frequently pushes you towards one specific option.

Other Factors to Consider

Other things to consider when comparing home insurance companies include:

Mobile Apps, Website Accessibility, & Overall Convenience: You may be dealing with your home insurance company frequently. You want a company with good mobile apps, an accessible website, and other features. It may sound basic, but many smaller insurers have outdated websites compared to nationwide brands.

Local Agents or Offices: Sometimes, it helps to choose a home insurance company with an office in your area – especially if you like to build a professional relationship with your insurance agent.

Available Discounts: Home insurance companies typically offer similar discounts – like bundling discounts and home safety feature discounts. However, some insurers offer unique discounts and programs – like a military discount or HOA discount – that may help you save money.

Compare Quotes Based on Similar Coverage: Some insurers dazzle you with cheap premiums, only for you to discover they’ve stripped away most of your coverage to impress you with low rates. When comparing quotes online, make sure you compare plans with similar coverages. You don’t want to compare a replacement cost policy with an actual cash value policy, for example, because the two policies cover different things. You don’t want to compare a $500,000 home insurance policy with a $425,000 insurance policy. Make sure you’re comparing similar plans.

Final Word

Buying a house may be the largest financial investment you make. Home insurance protects that investment. Once you have found your perfect fit, reach out to a public adjuster in your area and ask them to review your new policy. Most of them will offer this service for a small fee or no fee at all. They can tell you what is missing and what can be added so that you are fully covered for any loss that may happen.

By shopping around for the right home insurance company today, you can ensure you pick the one best suited for your unique needs.

Facing issues with a bad home insurer?

ClaimsMate fights back against insurance companies acting in bad faith. Contact ClaimsMate today for a free consultation with a licensed public adjuster in your area.

Article Here: How to Pick a Good Home Insurance Provider: Tips & Best Practices

No comments:

Post a Comment